UP NEXT

May

01

2024

The newest members of the Gilmore Young Artists family come together in one of the loveliest venues in town. Ms. Shao will play Bach’s Partita 5,... More Info

May

01

2024

Gabriela Montero: Westward

Gabriela Montero’s visionary interpretations and unique compositions have garnered critical acclaim and a devoted following. Celebrated for her... More Info

May

02

2024

Bluey's Big Play

Join the Heelers in their first live theatre show made just for you, featuring brilliantly created puppets, this is Bluey as you’ve never seen it... More Info

Accessibility Info

May

02

2024

Paul Lewis: Schubert Sonata Series II

In a special Festival event, British pianist Paul Lewis will present a survey of Franz Schubert’s monumental contribution to the classical... More Info

May

02

2024

Gerald Clayton Trio

Four-time GrammyⓇ-nominated pianist and composer Gerald Clayton’s innovative approach to jazz has charmed audiences and critics across the globe.... More Info

May

02

2024

Beaton, MacGillivray, and MacNeil: A Cape Breton Trio

Andrea Beaton, piano, fiddle

Troy MacGillivray, piano, fiddle

Tracey Dares MacNeil, piano, fiddle

Andrea Beaton, Troy MacGillivray, and Tracey... More Info

May

02

2024

Gerald Clayton Trio

Four-time GrammyⓇ-nominated pianist and composer Gerald Clayton’s innovative approach to jazz has charmed audiences and critics across the globe.... More Info

May

03

2024

An Intimate Evening with David Foster and Katharine McPhee

Sixteen-time Grammy Award®–winning musician, composer, and producer David Foster joins forces with acclaimed singer and television/Broadway star... More Info

May

03

2024

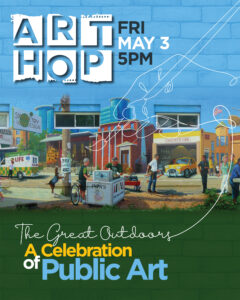

Art Hop MAY 2024 - The Great Outdoors (A Celebration of Public Art)

Spring is here, and Michiganders are ready to go outdoors! The May Hop will highlight our ever-growing vibrant public art collection and the beauty... More Info

May

03

2024

Beaton, MacGillivray, and MacNeil: A Cape Breton Trio event

Andrea Beaton, piano, fiddle

Troy MacGillivray, piano, fiddle

Tracey Dares MacNeil, piano, fiddle

Andrea Beaton, Troy MacGillivray, and Tracey... More Info

Accessibility Info

May

03

2024

May

03

2024

STATE ON THE STREET: A Cape Breton Trio (presented by The Gilmore)

Patio & Bar: 5:30 PM | Live Music: 6:00 PM

State on the Street is back for select Fridays this Summer! Join us outside the historic Kalamazoo State... More Info

Accessibility Info

May

01

2024

Kasey Shao and Harmony Zhu, 2024 Gilmore Young Artists

The newest members of the Gilmore Young Artists family come together in one of the loveliest venues in town. Ms. Shao will play Bach’s Partita 5,... More Info

May

01

2024

Gabriela Montero: Westward

Gabriela Montero’s visionary interpretations and unique compositions have garnered critical acclaim and a devoted following. Celebrated for her... More Info

May

02

2024

Paul Lewis: Schubert Sonata Series II

In a special Festival event, British pianist Paul Lewis will present a survey of Franz Schubert’s monumental contribution to the classical... More Info

May

02

2024

Gerald Clayton Trio

Four-time GrammyⓇ-nominated pianist and composer Gerald Clayton’s innovative approach to jazz has charmed audiences and critics across the globe.... More Info

May

02

2024

Beaton, MacGillivray, and MacNeil: A Cape Breton Trio

Andrea Beaton, piano, fiddle

Troy MacGillivray, piano, fiddle

Tracey Dares MacNeil, piano, fiddle

Andrea Beaton, Troy MacGillivray, and Tracey... More Info

May

02

2024

Gerald Clayton Trio

Four-time GrammyⓇ-nominated pianist and composer Gerald Clayton’s innovative approach to jazz has charmed audiences and critics across the globe.... More Info

May

03

2024

The Faith Quashie Qaurtet

Introducing the Faith Quashie Quartet – a harmonious fusion of musical talents that redefines the essence of jazz. This quartet is not just a... More Info

May

03

2024

An Intimate Evening with David Foster and Katharine McPhee

Sixteen-time Grammy Award®–winning musician, composer, and producer David Foster joins forces with acclaimed singer and television/Broadway star... More Info

May

03

2024

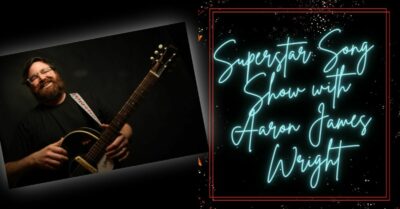

Superstar Song Show: WSG Aaron James Wright

Crawlspace Comedy Theatre presents the Superstar Song Show. For those “in the know” improv-wise, this could be described as a song–based... More Info

Accessibility Info

May

04

2024

Slaptail Nation Presents: Slap Your Tail Comedy

Saturday, May the 4th…

If you know, you know…

Star Wars Show

A long time ago, in a village not far, far, away, a young man dreamed of the... More Info

Accessibility Info

May

06

2024

May

06

2024

Early Bird Comedy Open Mic

Early Bird Comedy Open Mic is headed to the KNAC building. Yes, open mic comedy in an old church. Crawlspace Comedy Theatre is the place, 7:30pm... More Info

Accessibility Info

May

07

2024

Golden Girls: The Laughs Continue

Picture it. United States, 2024. Golden Girls: The Laughs Continue brings Miami’s sassiest seniors to stages around the country for one more... More Info

Accessibility Info

May

10

2024

Canned Champagne

Described as “an eclectic group of improv-ers…a variety pack, if you will,” Canned Champagne is classy, yet down to earth; effervescent, yet... More Info

Accessibility Info

May

11

2024

Blunder Bus

High-energy games and fun characters are front and center with Blunder Bus as they find the hilarity in everyday life! This team performed double... More Info

Accessibility Info

May

18

2024

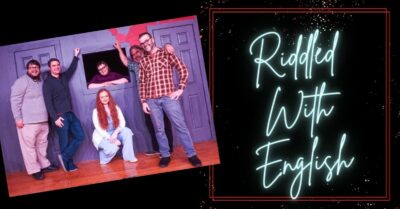

Riddled With English

Since the dawn of time, improv troupe Riddled with English has entertained the masses. Now, it’s your turn. High energy, short games, with lots of... More Info

Accessibility Info

May

03 - 04

2024

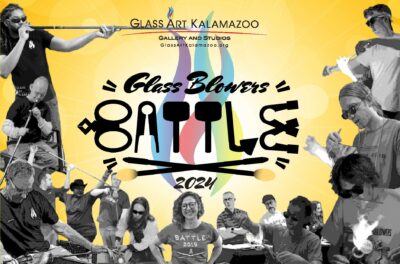

Glass Blowers Battle 2024

Glass blowers from all over the region descend upon the Glass Art Kalamazoo studios for two days of head-to-head battle in the hot shop and flame... More Info

Jan

20

2024

-

May

12

2024

Kyungmi Shin: A Story to Finding Us

Kyungmi Shin: A Story to Finding Us continues the artist's explorations of the historical narratives embedded in painting and ceramic practices... More Info

Apr

30

2024

-

May

24

2024

The Art of Playing with Knowledge, by Angela Lorenz

Join us for an Art Hop Reception for The Art of Playing with Knowledge, by Angela Lorenz, on Friday, May 3, from 5-8 PM.

Angela's conceptual approach... More Info

Jun

13

2024

Blue Landscapes

Michigan photographer Emily J. Gómez will share her work in New Cyanotype, explaining how and why she uses this handmade blueprint process. Through... More Info

Accessibility Info

Jul

18

2024

Indigenous Art and Activism

Seth Thomas Sutton is an Emmy-nominated Métis artist, scholar, author, and activist. He holds Masters degrees in Visual and Critical Studies from... More Info

Accessibility Info

May

03

2024

-

Aug

18

2024

2024 West Michigan Area Show

The work of West Michigan’s talented artistic community is on view during the annual West Michigan Area Show. Opening Friday, May 3, this... More Info

Accessibility Info

May

18

2024

-

Aug

25

2024

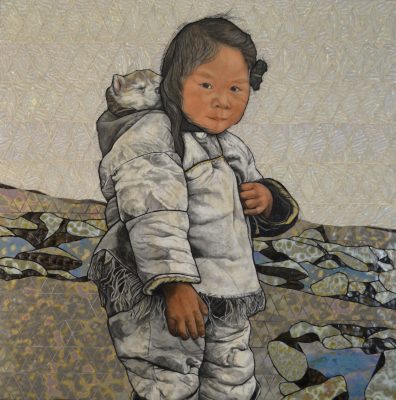

Clearly Indigenous: Native Visions Reimagined in Glass

To honor of our 100th Anniversary and continue our commitment to presenting the myriad of voices that make up the American experience, the KIA is... More Info

May

25

2024

-

Sep

01

2024

The Anniversary Show: Promised Gifts from the Joy and Timothy Light Collection

The Anniversary Show: Promised Gifts from the Joy and Timothy Light Collection showcases a diverse selection of Chinese and Japanese artworks on... More Info

May

03

2024

Art Hop MAY 2024 - The Great Outdoors (A Celebration of Public Art)

Spring is here, and Michiganders are ready to go outdoors! The May Hop will highlight our ever-growing vibrant public art collection and the beauty... More Info

Jul

12

2024

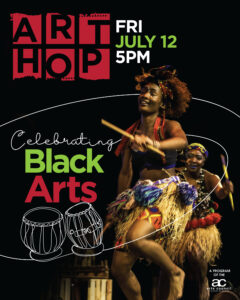

Art Hop JULY 2024 - Celebrating Black Arts

For the July Art Hop, we celebrate the Black Arts and Cultural Center’s Black Arts Festival - a special, annual event that has been a must-attend... More Info

Sep

06

2024

Art Hop SEPTEMBER 2024 - Resilience: Vehicle and Voice

Resilience is the process and outcome of successfully adapting to challenging life experiences through mental, emotional, and behavioral flexibility... More Info

Nov

01

2024

Art Hop NOVEMBER 2024 - The Art of Practice (Focus on Students and Arts Education)

Arts Education is an opportunity to create a safe and creative environment for individuals to try new things, express themselves, and build their... More Info

Dec

06

2024

Art Hop DECEMBER 2024 - A Year in Review

What journey have we taken in 2024? Whether up or down and all spaces in between, part of the experience has gotten us to where we are right now.... More Info

May

04

2024

Hip-Hop on Stage

This three-week class, led by Sara Sherman, offers a platform for aspiring performers to explore the fusion of hip hop and Broadway, allowing them to... More Info

May

11

2024

Crescendo Fiddlers - Fiddle Club

Director Joanna Steinhauser teaches folk fiddle music, which includes fiddle tunes from the folk music traditions of New England, Appalachia,... More Info

May

11

2024

Arts Exploration Lab for Teens

Teens can choose up to 4 workshops to explore the arts in ways that they may not have experienced in school. Twelve visual arts workshops cover many... More Info

Accessibility Info

Jun

17 - 21

2024

Kids Improv Summer Camps ★ AGE 5-7 ★

Campers will have fun in these improv theater camps while building confidence and leadership skills. They will play improv games, be creative, and... More Info

Accessibility Info

Jun

17 - 21

2024

Kids Improv Summer Camps ★ AGE 8-10 ★

Campers will have fun in these improv theater camps while building confidence and leadership skills. They will play improv games, be creative, and... More Info

Accessibility Info

Jun

17 - 21

2024

Epic Broadway! Musical Theater Camp

Work with Teaching Artists who have spent decades teaching and coaching singers in vocal technique and performance specifically for the musical... More Info

Jun

24 - 28

2024

Kids Improv Summer Camps ★ AGE 8-10 ★

Campers will have fun in these improv theater camps while building confidence and leadership skills. They will play improv games, be creative, and... More Info

Accessibility Info

Jun

24 - 28

2024

Kids Improv Summer Camps ★ AGE 11-13 ★

Campers will have fun in these improv theater camps while building confidence and leadership skills. They will play improv games, be creative, and... More Info

Accessibility Info

The Community Box Office Hours:

Box Office Hours are Monday through Friday, 10 am - 6 pm, with closing for lunch from 1:30 pm - 2:30 pm. You may contact the box office at 269.250.6984.

ACGK Office Hours:

ACGK offices are open to the public Tuesday through Friday, 8:00 am to 6:00 pm.

You may also contact us at: 269.342.5059 or email us at: info@kalamazooarts.org.